22 December 2024

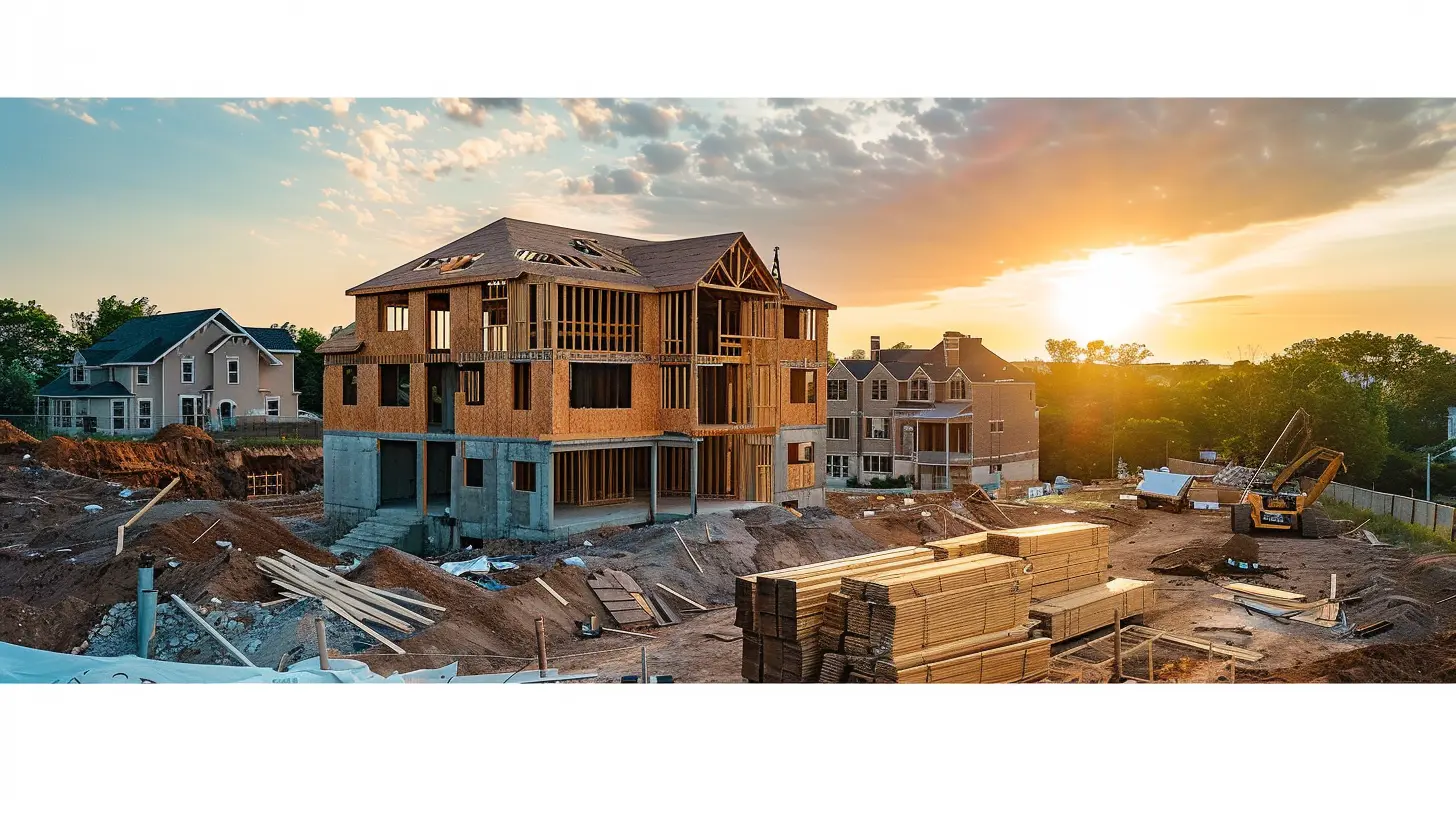

When it comes to buying a newly-built home, it’s easy to get caught up in the excitement. Freshly painted walls, pristine countertops, and the new-home smell are hard to resist. But amidst all the excitement, there's an essential topic homeowners often overlook: title insurance. Wait, what? Title insurance? Isn’t that something only older homes need?

Well, not so fast. If you’re building or buying new construction, title insurance is just as important—think of it as a safety net for your dream home. Let’s dive into what makes this insurance so vital and how it protects your investment both now and in the future.

What Is Title Insurance?

Okay, let’s start with the basics. Title insurance is a type of protection for homeowners and lenders. It ensures that your home’s title (essentially the legal claim to your property) is free and clear from any disputes, errors, or lingering issues. The keyword here is clear.Imagine buying your dream home, only to discover months later that a distant relative of the previous landowner claims ownership—or that there was an unpaid lien left behind by a contractor. Sounds like a nightmare, right? Title insurance swoops in to prevent those kinds of situations. It gives you peace of mind that you're the rightful owner of your property, no strings attached.

Why Is It Important for New Construction?

Now, you’re probably thinking, “Wait, why would I need this for a brand-new home? Nobody’s lived in it before!” True, but here’s the catch: title issues can arise on the land the home is built on.1. Land Ownership Problems

Even though your house is shiny and new, the land it’s sitting on may not be. Land changes hands over decades, and any hiccups in the chain of ownership can come back to haunt you. Maybe a previous owner never properly transferred ownership, or there’s a misrecorded deed somewhere in the mix. Without title insurance, you could be on the hook to resolve these issues.2. Liens and Unpaid Debts

Here’s a tricky one: what if the developer or builder left unpaid debts? Contractors, subcontractors, or suppliers may file a mechanic’s lien against your home because they weren’t paid for their work or materials. That lien doesn’t magically disappear just because you now own the home. Title insurance covers these surprises so you don’t have to.3. Survey Errors and Boundary Disputes

New construction also involves land surveys to establish property boundaries—and sometimes, mistakes happen. Imagine if your neighbor claims part of your driveway or backyard as their own because of an error on the survey? Title insurance helps protect against these types of boundary disputes.

Types of Title Insurance: Which One Do You Need?

Okay, so we’ve established that title insurance is essential. But did you know there are two types of policies? Yep, let’s break them down:1. Owner’s Title Insurance

This one’s all about you, the homeowner. Owner’s title insurance ensures that your ownership rights are protected from claims or disputes. It’s a one-time purchase that lasts as long as you (or your heirs!) own the home.2. Lender’s Title Insurance

If you’re taking out a mortgage, your lender will likely require you to get lender’s title insurance. But here’s the kicker: this policy protects them, not you. It’s designed to safeguard the lender’s financial interest in your home.Pro tip: While lender’s title insurance is mandatory with most loans, owner’s title insurance is technically optional—but skipping it is like walking a tightrope without a safety net.

How Much Does Title Insurance Cost for New Construction?

Good news: title insurance is a one-time expense—it’s not something you’ll be paying annually like homeowner’s insurance. The cost generally depends on your home’s location and its purchase price but typically ranges from a few hundred to a couple thousand dollars.For new construction, costs may also include coverage for risks unique to newly-built homes, such as mechanic’s liens. While it might feel like yet another expense on top of everything else, it’s a small price to pay for years of peace of mind.

What’s Covered Under Title Insurance?

Here’s where things get real: owner’s title policies are like a security blanket for homebuyers. Here’s a snapshot of what they typically cover:- Third-Party Claims: If someone pops out of the woodwork claiming ownership, title insurance has your back.

- Property Liens: Whether it’s unpaid taxes or contractor bills, you’re shielded from financial liability.

- Boundary Disputes: Protects against issues stemming from survey errors or unclear lot lines.

- Fraud or Forgery: Even with today’s technology, fraudulent deeds or forged documents can slip through the cracks.

But here’s the thing: read the fine print! Coverage can vary based on the policy and provider, so don’t hesitate to ask questions before signing on the dotted line.

The Process of Getting Title Insurance

Getting title insurance isn’t difficult—it’s usually handled through the title company or closing agent during the home-buying process. Here’s a quick rundown:1. Title Search: The title company will dig into the history of the property to identify any potential issues, like liens or ownership disputes.

2. Clearing Issues: If problems pop up during the search, the title company works to resolve them before you take ownership.

3. Policy Issuance: Once everything checks out, the title company issues the policy, officially protecting your ownership.

FAQs: Let’s Answer Your Burning Questions

Q: Can I skip title insurance for new construction?Technically, you can—but we wouldn’t recommend it. Even brand-new homes can run into title issues, and without insurance, you’re left holding the bag.

Q: How long does title insurance last?

For owner’s policies, it’s a one-time purchase that lasts as long as you own the home. Lender’s policies, however, are tied to the life of your loan.

Q: Does title insurance cover everything?

Not quite. Title insurance focuses on past issues—not future ones. To protect against future risks (like storm damage), you’ll need homeowner’s insurance.

Wrapping It All Up

Building or buying a new home is one of the biggest investments you’ll ever make. And while the idea of title insurance might not be as thrilling as picking out countertops or paint colors, it’s one of the smartest decisions you can make to protect your investment.Think of it like a seatbelt for your financial future—it’s there to catch you when the unexpected happens. After all, you’re not just buying four walls and a roof; you’re buying peace of mind.

So, the next time someone asks, “Do I really need title insurance for new construction?” you’ll know the answer: a resounding yes.

Declan McCarty

In dreams of new foundations, where hopes entwine, Title insurance whispers, “Your future is mine.” Guarding against shadows of what-ifs and mights, With every brick laid, secure your delights. A fortress of trust for your home’s radiant light.

February 12, 2025 at 12:28 PM