March 30, 2025 - 01:30

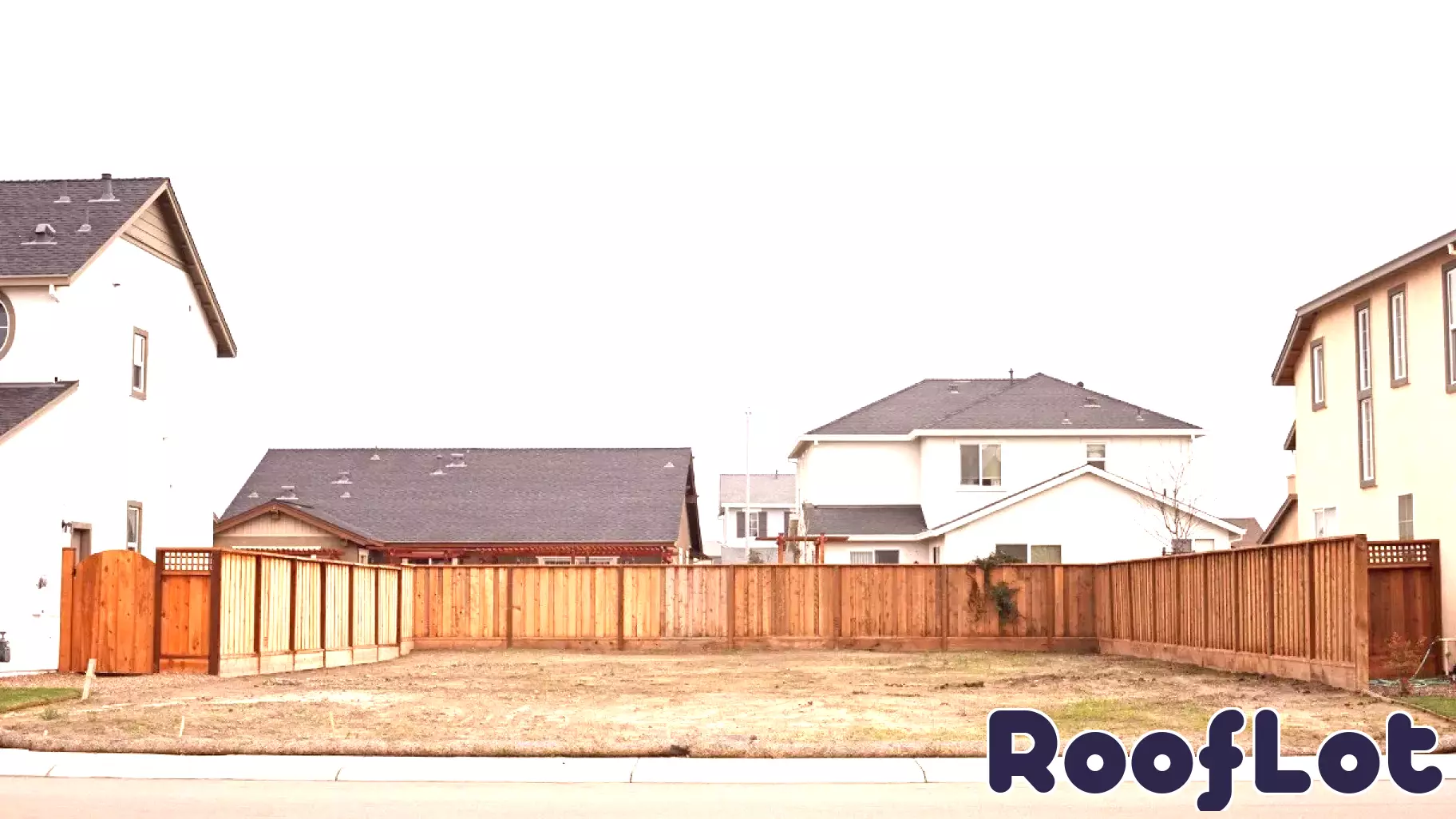

The land value tax (LVT) proposes a novel approach to addressing the ongoing housing shortage by taxing land at a higher rate than the structures built upon it. This system encourages landowners to develop their properties more efficiently, as holding onto unused or underdeveloped land becomes less financially appealing. By prioritizing land use over the buildings themselves, the LVT aims to stimulate construction and increase the availability of housing.

Proponents argue that this tax structure could lead to more affordable housing options, as it incentivizes the development of vacant or underutilized land in urban areas. Additionally, by reducing speculation on land, the LVT could help stabilize property prices, making housing more accessible to a broader range of people.

Critics, however, raise concerns about the implementation of such a tax, questioning its potential impact on existing property owners and the overall economy. As cities grapple with housing shortages, the land value tax presents a compelling, albeit controversial, solution that merits further exploration.