28 November 2024

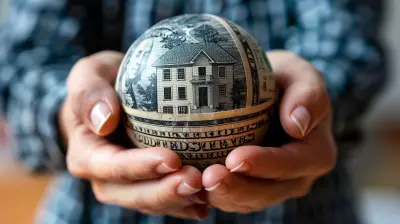

Buying your first home is an exciting milestone, but let’s be real—it’s also a bit of a rollercoaster. From finding the perfect home to navigating the loan process, there’s a lot to unpack. And just when you think you’re getting the hang of it, here comes the home appraisal process to throw a curveball your way.

But don’t panic! The home appraisal process is not as intimidating as it seems. In fact, it’s one of the most important steps in ensuring you’re paying the right price for your new home. So, grab a cup of coffee, sit back, and let’s break this down into simple terms.

What Is a Home Appraisal (And Why Should You Care)?

Okay, let’s start with the basics. A home appraisal is like a report card for your future house. It’s an unbiased estimate of the home’s value, determined by a licensed appraiser. Think of the appraiser as a neutral third party—kind of like a referee—there to make sure the price you’re paying (and your lender is approving) makes sense based on the home’s condition, location, and market trends.Why does this matter? In short: money. If you’re financing your home through a mortgage, your lender isn’t just going to take your word for it that the house is worth what you’re paying. They need an official appraisal to ensure they’re not handing over more money than the property is worth.

If the appraisal comes back lower than your agreed-upon purchase price, well, now we’ve got a conversation to have (we’ll get to that in a bit).

When Does the Appraisal Happen?

Timing-wise, the appraisal usually happens after your offer is accepted but before you close the deal. Once you’ve signed the sales contract, your lender will typically order the appraisal on your behalf.The appraiser will visit the home, take a deep dive into its condition, and compare its features to similar homes in the area that have recently sold (what industry folks call “comps”). Don’t worry—they’re not there to critique your future décor choices or judge the amount of natural light in the guest bathroom. Their job is strictly about determining fair market value.

Who Pays for the Appraisal?

Here’s the deal: you, the buyer, are usually responsible for covering the cost of the appraisal. Surprise! It's one of those sneaky little expenses that pop up during the homebuying process.The average cost of a home appraisal is typically between $300 and $500, depending on the property’s location, size, and complexity. It’s worth noting that this fee is non-refundable, even if the deal ends up falling through.

What Does the Appraiser Look At?

This isn’t just a quick walk-through. Appraisers consider a variety of factors to determine the home’s value. Here's a breakdown of what they’re typically evaluating:1. The Home’s Condition

Is the roof in good shape? Are there any obvious signs of damage, like cracks in the foundation or water stains on the ceiling? The appraiser will take detailed notes on the home's structural soundness, maintenance, and overall livability.2. The Size of the Property

Square footage matters, folks. The appraiser will measure the interior and exterior dimensions of the house to get a sense of how much space you're paying for.3. Location

Location can make or break a home’s value. Is the house in a good school district? Is it close to major highways or public transit? What’s the neighborhood like? Location is one of the biggest influences on a home’s appraisal value.4. Comparable Properties

Remember those “comps” we mentioned earlier? The appraiser will look at recent sales of similar homes in the area to get a benchmark for pricing. For example, if three similar homes sold for $250,000, and your seller is asking for $300,000, that might raise a few red flags.5. Upgrades and Features

Does the home have any unique features, like a pool, finished basement, or an upgraded kitchen? These can add value to the home—but don’t get too carried away. A fancy hot tub in the backyard may not be worth as much as you’d hope.What Happens If the Appraisal Comes Back Low?

So, here’s the scenario: Let’s say you’ve agreed to pay $275,000 for the house, but the appraisal comes back at $260,000. That $15,000 difference? Yeah, that's a problem. Lenders won’t approve a loan for more than the appraised value.But don’t freak out just yet—there are ways to handle this:

1. Negotiate with the Seller

You can ask the seller to lower their asking price to match the appraised value. Many sellers will agree, especially if they’re motivated to close the deal quickly.

2. Pay the Difference in Cash

If you’re able, you can cover the gap out of pocket. This isn’t ideal for everyone, but it’s an option if you’re fully committed to the house.

3. Challenge the Appraisal

If you think the appraiser missed something important or didn’t use accurate comps, you can request a review. This doesn’t guarantee a different outcome, but it’s worth a shot.

4. Walk Away

As painful as it sounds, sometimes walking away is the smartest move. Remember, there are plenty of fish in the sea (or in this case, houses on the market).

How to Prepare for a Smooth Appraisal Process

While most of the appraisal process is out of your hands, there are a few things you can do to help things go smoothly:1. Work With a Reputable Lender

Choose a lender who knows what they’re doing and has experience working with quality appraisers.2. Be Objective About the Home's Value

Don’t let emotions cloud your judgment. Falling in love with a house is great, but it’s important to balance that with a practical understanding of its market value.3. Communicate With Your Agent

Your real estate agent is your biggest advocate during this process. They can help you understand the appraisal report and negotiate if any hiccups arise.4. Don’t Skip the Pre-Approval Process

Getting pre-approved for a mortgage can give you a clearer picture of your budget and help you avoid overcommitting.The Bottom Line

The home appraisal process might seem like just another hoop to jump through, but it’s there to protect you (and your wallet). Think of it as a safety net, making sure you don’t overpay for a home that isn’t worth the sticker price.Sure, the process can feel a little nerve-wracking, especially if you're a first-timer. But armed with knowledge, patience, and a solid support system (hello, real estate agent!), you'll make it through just fine.

So, the next time someone brings up home appraisals, you can confidently say, “Oh, yeah, I’ve got that covered.

Peyton Bowers

Appraisals: That's how reality checks come in style!

February 9, 2025 at 1:41 PM